The emergence of artificial intelligence has triggered a revolution in the financial sector, unleashing a wave of transformative advancements. This technology has paved the way for groundbreaking solutions to previously daunting challenges, such as extracting and analysing data and enhancing decision-making processes through new knowledge. Moreover, AI is reshaping the customer service landscape, revolutionising user interactions and optimising the customer experience.

Both traditional banks and innovative banking companies are leveraging AI to bolster their competitive edge and forge pathways to new revenue streams. The automation facilitated by AI is streamlining operational processes, affording greater efficiency while minimizing costs. Although this digital transformation is still in its nascent stages, an increasing number of companies are embracing the potential of AI through softwares such as KORTO, which help with document management and processing.

The incorporation of artificial intelligence in the field of finance is paving the way for a transformative era characterized by data-driven decision-making, enhanced operational efficiency, improved security measures, and elevated customer experiences within the financial sector. Here are some of the ways how AI has left its trail in the banking systems:

Improving Efficiency Through Document Management

Document management solutions play a vital role in speeding up document processing cycles by optimizing the allocation of funds through collaborative scanning of different document types, information extraction and automated document sorting. In the fast-paced banking industry, the ability to swiftly examine and organize documents is crucial in effective operations. As regulations for banks of all are constantly evolving, banks need to be able to adapt. Document management software is instrumental in ensuring compliance by providing comprehensive, auditable, and secure data capture.

Document management solutions enable banks to promptly and accurately address customer inquiries using valuable information from customer documents. With the help of document management software, banks can swiftly access the necessary information without the need to manually sort through numerous pages, thus enhancing the speed and accuracy of customer service.

Fraud Prevention

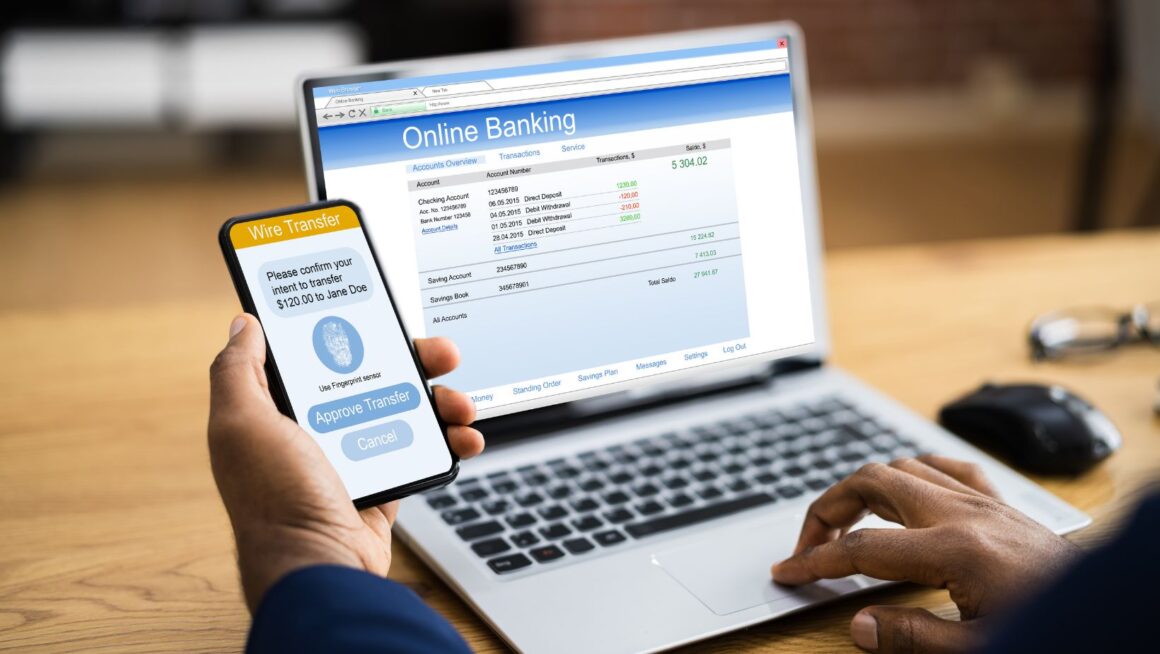

One of the key roles of artificial intelligence in the realm of financial transactions is its contribution to fraud prevention. By analyzing vast quantities of transactional data and utilizing machine learning algorithms, AI can identify unusual patterns and suspicious activities. For instance, if a credit card displays irregular transactions, the AI system can notify the authorities or temporarily halt the transaction to safeguard the cardholder.

Personalized Customer Service

AI is revolutionizing customer service by allowing banks to offer tailored and individualized experiences. By assessing customer behaviour and preferences, banks can develop personalized offers to enhance customer satisfaction and cultivate loyalty.

Some AI-based platforms even provide automated financial advisory services, delivering tailored investment guidance, retirement planning, and debt management advice based on a comprehensive analysis of a customer’s financial solution.

Risk Management and Compliance

AI significantly impacts risk management in the banking sector. AI-based systems facilitate the identification and evaluation of risks, enabling banks to make more informed credit decisions.

Additionally, AI assists in adhering to regulatory requirements by aiding in the detection of money laundering activities. While traditional risk assessments in financial institutions have relied on static models and historical data, AI enables the real-time analysis of large volumes of transactional data, resulting in more precise and up-to-date risk assessments.

The future of AI in banking

The future definitely looks promising. By integrating AI into their systems, banks not only economize but also have the potential to devise innovative business models. AI is poised to become an indispensable tool for driving digital transformation in the financial sector.